Each year thousands of manufacturers contact Software Connect for help selecting Material Requirements Planning (MRP) software to support their processes. These regular conversations provide us unique insight on market trends and software buyers’ needs.

We reviewed our notes on a random sample of 183 conversations with manufacturers looking for MRP software in 2017. We have categorized and analyzed their motivations and requirements in the following report.

MRP Software Buyer Trends: Key Findings

- Three MRP features are head-and-shoulders above the rest on manufacturers’ must-have lists.

More than 70% of buyers are looking for purchase planning, demand forecasting, and master production scheduling. - More than 65% of MRP software buyers are actually looking for a full blown ERP system that includes core accounting features. Order management is a close second.

- MRP buyers are 45% less likely to have a preference for hosted systems.

- 29% of MRP software buyers are replacing QuickBooks.

Why Manufacturers Buy MRP Software

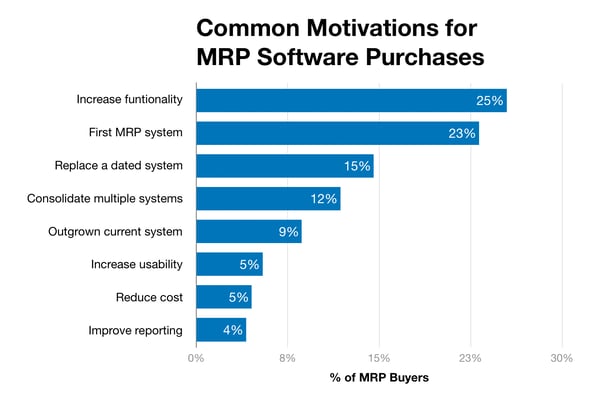

Approximately one-quarter of manufacturers surveyed want to purchase new MRP software in order to increase functionality, while another 23 percent indicate they are first-time MRP system buyers. Just over 14 percent of businesses want to replace a dated system, whereas nearly 12 percent are pursuing the benefits of consolidating multiple MRP systems with a single package.

Most Desirable MRP Software Features

Poor planning can leave some machines unused even as work piles up at others. As a result, purchasing planning (79 percent), demand forecasting (76 percent) and master production scheduling (72 percent) are the MRP features most in demand by MRP software buyers. That makes sense, given that an MRP system could be used to determine, for example, what assemblies must be built and what materials must be purchased — and when — in order to build completed products on time to meet customer deadlines. All three features are commonly found in leading MRP packages, including those from Oracle, JDEdwards and SAP [and xTuple].

“The three most sought-after features among the manufacturers surveyed — purchase planning, demand forecasting, and master production scheduling (MPS) — are no great surprise, because they all impact the concept of visibility.”

— Dave Lechleitner, Director of Solutions and Product Marketing for KeyedIn Manufacturing

More than half of purchasers are likewise looking for software with inventory reservation/availability (60 percent), production cost reporting (58 percent) and item price/stock tracking (54 percent) features. A slightly smaller number of buyers cite shop floor control (48 percent) and equipment maintenance scheduling (44 percent) as requirements.

Manufacturing ERP Functions

Customers require many non-MRP functions as well, of course. Core accounting (AP, AR, GL) and order management functions are most in demand, with 68 percent and 64 percent of manufacturers surveyed citing them as MRP add-on requirements, respectively. More than half of companies surveyed (54 percent) indicate that purchase order capabilities are in demand. That requirement is followed by bank reconciliation (30 percent), bill of materials (25 percent), job cost and MES (both at 20 percent) and customer relationship management (CRM, 19 percent).

Many organizations desire a full MRP+ERP solution for tighter control over production costs and profitability. A made-to-order metal sheets and parts manufacturer in Wisconsin, for example, wants a full system to capture manufacturing costs (labor and materials) for accurate pricing purposes. Another manufacturer, an Oregon-based made-to-order airplane fabricator, likewise expressed interest in a full system to accurately capture machine production data in order to understand profitability.

Hosted vs. On-Site

Manufacturers claim to be very flexible in how they are willing to deploy MRP software, with nearly three-quarters (71 percent) indicating they would be open to reviewing either hosted or on-site installation options. Only 15 percent insist on a hosted solution, whereas 14 percent are interested in on-site installation only. To provide just a couple of examples, a beer brewer in remote part of Alberta and a chemical manufacturer for healthcare industry in Chicago suburbs told us the company interested only in on-premise due to internet connectivity issues at their facilities.

“For most manufacturers, once they understand the unique value of a cloud solution — access anywhere, no overhead or equipment costs, and no messy upgrades — they embrace the concept quickly; but clearly more advocacy is needed.”

— KeyedIn’s Lechleitner**

What Products Are MRP Buyers Replacing?

Replacement of existing software investments does not appear to be a top priority. Whereas more than 29 percent of MRP buyers are planning to replace Quickbooks, 20 percent say their MRP system will not replace existing software. Only about 8 percent indicate that Sage 50c would be on the chopping block, with fewer than 5 percent saying the same of QuickBooks Enterprise, Microsoft Dynamics and Excel.

Report Demographics

Manufacturers responding to our survey specialize in job shop (37 percent), for stock (35 percent), process (12 percent), food/beverage (11 percent) and pharmaceuticals (4 percent). The majority of respondents’ companies have between 20 and 99 employees. Just over 23 percent fall into the next larger category (100 to 499 employees), with about 22 percent claiming fewer than 20 employees. Only about 10 percent of respondents have more than 500 employees.

Slightly more than 20 percent of respondents hold C-level, owner, president or VP job titles. Others identified themselves as consultants (15 percent), accounting staff (14 percent) or general managers (13 percent), with another 5 percent holding either operations manager or production manager titles.

The Takeaway

Regardless of the type of manufacturing that a company performs, the entire industry has essentially the same needs: create products as efficiently as possible while at the same time holding down inventory levels and costs. Manufacturers across the board want their MRP software to help accomplish those objectives through a wide variety of features, although the vast number of small to medium-sized manufacturers agree that purchasing, forecasting and scheduling are an MRP package’s most crucial functions. Some manufacturers want more out of their planning systems, and MRP is no exception when it comes to their search for a software package that can deliver broad functionality.

Software Connect provides a free software matching service that connects end users looking to evaluate software options. Our team of independent software experts can match organizations with the top software solutions that will best meet their needs.